:: ParamList ::

exec oc.GetBlogInfo

@DomainName = '.com' ,

@Language = 'en-US' ,

@BusinessUnit = 'OC' ,

@BlogCategory = '__ALL__' ,

@BlogType = 'Blog' ,

@BlogURL = 'fsa-hsa-hra-water-flosser' ,

@Brand = '__ALL__' ,

How to Use an FSA, HSA, or HRA for Better Dental Health

October 1, 2019

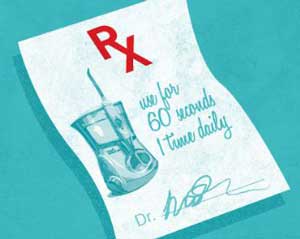

If a dentist prescribes a WATERPIK water flosser or WATERPIK Sonic-FusionTM for health reasons, you may be able to pay for it with your flexible spending or health savings account!

Eligible Medical Expenses Include Dental Issues

Expenses for preventing and treating dental diseases are allowable for a Flex Spending Account (FSA), Health Savings Account (HSA), or Health Reimbursement Arrangement (HRA).

For example, if a dentist diagnoses gingivitis and recommends a WATERPIK water flosser or WATERPIK SONIC-FUSION, under IRS guidelines it is an eligible expense.

Individual plans can vary, so it's best to verify eligibility with your provider.

3 Easy Steps to Use FSA, HSA, HRA Funds for a WaterpikTM Water Flosser or WaterpikTM Sonic-FusionTM

- Verify with your plan administrator that your purchase is covered

- Ask your dentist or periodontist to complete a Letter of Medical Necessity (below)

- If required, submit the letter and any required documentation to your plan administrator

Print Letter of Medical Necessity (PDF)

Page last updated: Nov 2, 2021